Chapter Three

If you're one of those persons eager to bootstrap a theatre company, let me just say this - I admire you, and wish you luck. Seriously. The push is on in theatre journalism to report some good news, and there have been a few articles in the major national newspapers from New York, DC, and Chicago touting some good news. American Theatre magazine is also doing its part to paint a rosier picture of the theatrical landscape as we head into 2024. So maybe your plans to start a theatre with some of your friends and colleagues may not be such a bad idea, after all. But please be warned: the odds of starting and sustaining a viable theatre are just as long and just as against you as the odds are of becoming a sustainable working actor.

In this post, I want to examine more closely the relationship between a theatre and its audience by digging just a tad deeper into the demographic information contained in the NEA's Survey of Public Participation in the Arts (SPPA). A deep look at this data should reveal to us in some measure what the demographic is for a successful theatre, and by extension what the market is for one. Not to give away the ending, but one thing should be immediately clear - theatre is a niche product. It appeals to a small and select group of individuals, and anyone contemplating starting a theatre has at least two choices: tap into the niche demographic, or grow and develop a different one. What we will find in the end is that there is no broad market to tap.

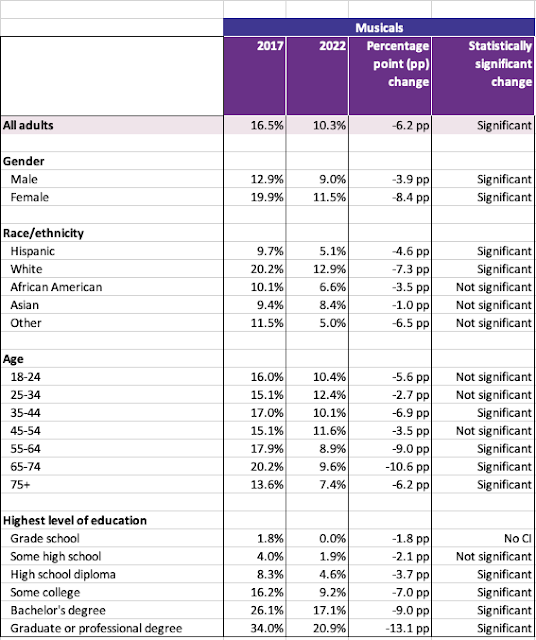

The two charts below will provide us with the data we need. Take a look at them.

The charts compare the numbers from the 2017 SPPA to the 2022 numbers. The first thing you will notice is that, in the column labeled "Percentage Point Change", every row has decreased, with the unusual category of 'Highest Level of Education:Grade School" in the non-musical plays chart going up 0.6 points, from 0.9% to 1.5%. In short, and as noted in Part 2, the market is declining at all levels.

Looking at specific categories and their decline, the ones that stand out most are as follows. Let's start with attendance at musicals:

- Females dropped from 19.9% to 11.5%, a -8.4 percentage point (pp) decrease.

- Whites dropped from 20.2% to 12.9%, a -7.3 pp decrease.

- Adults 65-74 years of age went from 20.2% to 9.6%, a whopping -10.6 pp decrease

- Adults with graduate degrees dropped from 34% to 20.9%, a -13.1 pp decrease, the largest in this category.

When it came to attendance at non-musical plays, the numbers paint a similar picture:

- The only category to drop double digits was the Graduate Degree category. Those with graduate degrees attending plays went from 21.6% to 10.1%, an 11.5 pp decrease.

- In the Race/Ethnicity category, whites dropped from 11.6% to 5.3%, a -6.3 pp decrease.

- The three sustaining age categories (and by this I mean people who probably have the means to afford theatre tickets) also saw significant drops. 45-54 went from 10% to 4.4% (-5.6 pp); 55-64 went from 9.7% to 3.8% (-5.9 pp); and 65-74 went from 11.5% to 5.2% (-6.3 pp).

And across both musicals and plays, perhaps the most troubling decreases are among college-educated people. I won't list the numbers here; you can find them on the charts. But the numbers are staggering in their percentage decreases, among the highest percentage point decreases across all categories. College-educated people seem to have stopped attending theatre in droves.

So, if we go down the charts using the 2022 numbers, and pick the highest percentage number out of each category to determine who the best demographic target is for your new theatre, we would want to at the very least try to attract the following audiences:

- For musicals, we would want to attract white females age 25-34 with a college degree, preferably a graduate or professional degree.

- For non-musical plays, it would be a white female age 35-44 with a college degree, preferably a graduate or professional degree. Of significant note, though, is that white females are only one-tenth of a percentage point higher than Black females statistically, as the race/ethnicity category shows African Americans at 5.2% of attendance, and whites at 5.3% of attendance.

In short, if you want to start a successful and sustainable theatre, your best bet is to appeal to professional women age 25-44, programming content that speaks to their lives and issues, and (although I don't have any data at all for this) also appeals to their children, should they have any. It will pay to be inclusive and diverse in your content and casting. Occasionally it will also pay to produce content for female senior citizens (Menopause the Musical serves as the prime example).

You can, of course, extrapolate from this data, but it's risky at best. Would rom-coms help bring in more males on dates with their partners? Would LGBTQ+ content expand the audience (one category the SPPA has not seemed to want to touch at all is sexual preference. That data would be most interesting)? Should children's theatre be an element? Would after school activities that can serve as a daycare service help sustain the bottom line? All these extrapolations, however, maintain the female-centric nature of your theatre. You're not doing David Mamet any time soon.

As to the actual data itself, there are some things to take into consideration. The first is that the data does not concern itself solely with professionally-produced art. If you went to see your child in their university production of The Glass Menagerie, you could truthfully answer "yes" to the question "did you attend at least one arts event in the past 12 months?" Plays and pageants presented at houses of religious worship count. In short, you did not have to attend a professionally-produced play or musical to answer "yes."

Another aspect of the survey is that it does not indicate how many people who answered the questions are themselves artists. I have always been interested in trying to find a data set that removes from the data any artists who attend arts events. As an example, in an average theatre audience, if you remove any audience members who are also theatre artists, as well as members of the production's families and their friends, how many people do you have left in the audience who have no relation at all with anyone connected to the production or the art form? In other words, how many people with no connection at all to the production or the art form professionally bought a ticket? That's the data I would like to have, and if we had it, I believe the picture would be far more disastrous than it already is. I suspect the largest category of people seeing theatre is theatre people and their family and friends.

I cannot with any degree of certainty say that there are not other niches out there that would do as well. At the community-based level, it is absolutely critical that you do the necessary marketing to find what that niche is. It is not enough simply to say "I want to start a theatre doing XX." You need to know what the market will support. Personal example: at one point in I believe the mid-90s I was approached about starting a Shakespeare company in my region. The first thing I told the proposed financer was the need to do a market study. We discovered that the region would only support a Shakespeare company if it were located in some proximity to a major regional cultural institution (10 minutes away or less), and we could convince the people there to attend the shows. I also worked up a first-year capital investment budget, which paid the actors and accounted for technical needs, that came to $30K. The idea soon died, because the market was not there, making a $30K investment (or any investment, for that matter) a waste of money.

In conclusion, there is no broad market for "theatre." The data points this out quite clearly. The data also points out that the success of building a sustainable theatre that has the capacity to support artists at even a modest standard of living is slim, given the low demand. Your odds of starting and sustaining a theatre are about as great as becoming a Broadway star, which makes either path viable once seen through this prism.

In Chapter Four, I will speculate as to "what comes next." The short answer is I've no idea. With the data as dismal as it is, with major theatres closing and crumbling, and with interest in theatre within the divided culture we inhabit about as low as it can get, I believe whatever comes next will take several generations to produce. I'll leave you with this quote from the 2022 SPPA:

At the same time, one should gravely view the overall declines in visual and performing arts attendance, based on the activity types that are listed in the survey. Those activities include art museum or gallery visits, and attendance at jazz, classical, or Latin/salsa music performances, musical and non-musical plays (emphasis mine), craft fairs and outdoor performing arts festivals, opera, and ballet and other dance forms. Ramifications of those declines were still being felt in the summer of 2023, when the closing of many regional theater organizations and shows began to make national news.

-Abercrombie